Due to rounding rules between items on your Sales and payments reports, you may notice some 1 cent discrepancies between your Sales and payments reports within the same period.

There are other cases where the Sales report does not match the record of payment collected. For example, when taking cash payments. In this case, a payment type solution has been applied and the cash rounding payment type will record the discrepancy against the account.

The article below explains why rounding discrepancies occur on your Sales and payments reports and things to keep in mind when reporting on your store.

Cash discounting terminology

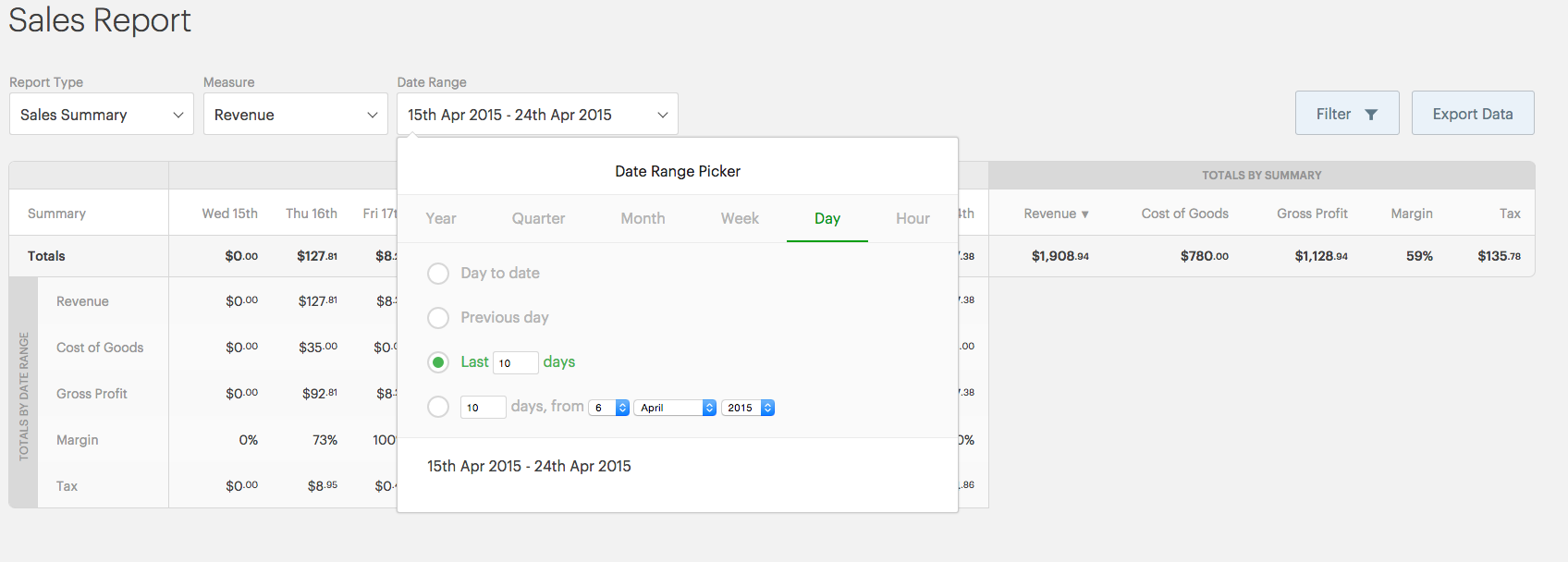

Sales report: Gives a breakdown of daily totals over a period.

Sales: This is money that should be paid to the store when all sales are closed. These sales will all have been created between the opening and closing time of your store, but they do not represent how much money has been received within this register closure period.

Payments: This is the sum of the total amount of money that has been received by payment type.

Payment report: Gives a breakdown of how much money has been received for each payment type in your store over a period.

Payment type: Payment types are different methods in store to receive money. This can include cash, credit card, gift card, On account, etc.

Cash rounding payment type: This is a feature in Retail POS that lets you pick different rounding denominations and rules depending on your country's currency. Learn more about Cash Rounding in Retail POS.

Revenue: The total value of sales in the specified period.

Retail price: The price of a product when it is sold to a customer.

Liabilities: A liability is an obligation to pay in the future. On account, store credit, gift cards or loyalty are recorded as liabilities and not payments in Retail POS.

Understanding the rounding discrepancy

If you process two sales in store, each with 1 of these products the price will be:

-

67.91981 + 4.07519 = 71.995 (Corresponding Payment Amount = $72.000000)

-

67.91981 + 4.07519 = 71.995 (Corresponding Payment Amount = $72.000000)

The total on your Sales report will be $143.99.

The total on you Payments report will be $144.00.

Retail POS does not automatically record this revenue discrepancy, due to the rounding rules in Retail POS.

Rounding rules in Retail POS

In Retail POS, everything is stored to 5 decimal places, except for payments, which are rounded to 2 decimal places as payments are based on standard purchasing rules. Retail prices and taxes are not rounded to 2 decimal places as this could cause a discrepancy.

Both the Sales report and Payments Reports have clear reporting lines:

-

Sales reports shows the net sales Revenue that you collect in store. This means that the Sales report shows gross revenue minus discounts, allowances and returns and is based on the retail price of products recorded on Retail POS.

-

The Payments report shows how much money has been received for each payment type in your store over a period. It shows revenue as the Amount owed and is recorded at the point of time the amount is owed, not when it was paid (as in at the time of sale). Payments are based on money received and rounded to 2 decimal places.

Cash rounding and Xero

Xero runs code to determine what the payment discrepancies are. This is then posted to your Till payment discrepancies account on Xero when you post your register closures.

Managing the cash rounding discrepancy

For cash rounding, Retail POS has the ability to create a cash rounding payment type. Due to materiality, the same has not been applied to the rounding discrepancies between Sales reports and Payment reports.

Materiality is an accounting concept that relates to the importance of recording an event or transaction. Accounting rules state that when you are dealing with large sums of money and rounding to the nearest decimal, do not round if rounding the sum would affect its materiality. Therefore, if the general information is correct and your reports are not materially misstated, the transaction can stand as it is.

As the rounding discrepancies between your Sales and payments reports will always be plus or minus 1 cent, these discrepancies are far below any retailer's materiality and can stand as it is.

Note:

- Cash discrepancy is normal, unless you're operating on a cash basis and did not offer On account, store credit, gift cards or loyalty, which would be recorded as liabilities and not payments.

- Figures in both your payments and revenue are correct and accurate, they display the accuracy available for each figure.

- Rounding discrepancies are normal and expected by an accountant. If you require more information, contact an Accountant.